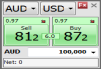

US Stocks Retreat as Fed Plans More Cuts in Stimulus $AUDUSD

- Published: 31 January 2014

- US stocks sank, dragging benchmark indexes to the lowest levels since November, amid disappointing earnings forecasts and the Federal Reserve’s plan to reduce stimulus even amid turmoil in emerging markets.

- The Fed announced that it will trim bond purchases by a further $10 billion to $65 billion a month. The Fed noted that “labor market indicators were mixed but on balance, showed further improvement”. We estimate that the Federal Reserve will wind back bond purchases by December 2014. Stocks fell to their lows of the session as policy makers pressed on with another $10 billion reduction in the monthly bond purchases intended to speed a recovery from the worst recession since the Great Depression.

- Yahoo slumped 7.4 percent as its sales forecast signalled slowing growth. Boeing Co. retreated 6.2 percent after its 2014 profit forecast trailed analysts’ estimates amid a slowing pace of jet orders. Dow Chemical Co. jumped 4.3 percent after stepping up its dividend and share-buyback plan.

- Dow Jones -1.19% S&P 500-1.02% and NASDAQ -1.14%

- The Yen gained against most emerging-market currencies as the Federal Reserve continued to trim monthly bond buying that has propped up global asset prices. Yen strengthened 0.6 percent to 102.29 per US dollar and 0.7 percent to 139.75 per euro.

- Gold advanced in London and New York on speculation a global rout of emerging markets will spur demand for precious metals as a safe haven. Gold for immediate delivery rose 0.2 percent to $1259.81 an ounce in London, after falling as much as 0.6 percent. April futures climbed 0.7 percent to $1259.40 an ounce in New York.