Commodities Trading

Commodity futures and futures options are traded by farmers, manufacturers, banks and other financial institutions as well as retail traders mainly for two reasons:

- To potentially profit from basic supply and demand. (retail traders)

- To hedge against price fluctuations (farmers, manufacturers etc)

A futures contract (commodities trading) is similar to an options contract. What a futures contract entails is a contract between two parties for a set price on a standardized quantity of a certain asset which is agreed upon and then actually carried out using the contract at a later date. A futures contract normally comes with an obligation to actually carry out the futures contract (commodities trading) before the expiration of the contract. An options contract leaves no obligation. They’re both long and short futures contracts depending on the agreement which is made between the buyer and the seller of the assets.

Usually when it comes to futures contracts (commodities trading) the investor has to post a performance bond which is insurance that they are going to carry out the futures contract. Usually a bond is between five and 15% of the contract value. Bonds can be waived in some cases depending on the agreement that’s made between the buyer and the seller, but generally bonds make it quite difficult to make a direct profit off of the futures contract over the short term.

Futures contracts (commodities trading) are normally traded in order to get a better deal on commodities. Or to be traded later on as future contracts themselves to people who will be interested in these commodities during volatile market stages. The person is able to collect a good deal on a future and carry it through to purchase the commodities that they need for their business, it is possible for trader to save money in the future when commodities experience volatile prices are high raises the prices. As well from a trader’s perspective simply buying and selling the futures contracts to people who require the commodities during a time when the market is up, can have the making of healthy profit just by making the futures contract at the right time.

Studying the market and always being sure of what commodities are trading at while the trader to make educated decisions on when to trade futures and what the best price for a futures contract is. There are a number of ways in which people can start making futures contracts (commodities trading) and actually trading futures.

If you’re new to trading futures it is probably best to start by talking to a trading professional or broker that specializes in trading futures. From there you’ll be able to know exactly what the best future investments are and what commodities markets are the best to look at. Whether you decide to go through a broker or decide that online trading is best for you is entirely up to how much risk you want to put into your trading. While trading online can result in better profits and not having to pay a fee for brokerage, most of the responsibility for doing research and actually trading futures at the right moment falls on the shoulders of the traitor and not on a broker. Each side has its own benefits.

As worldwide markets will always need commodity trading futures contracts (commodities trading) will continue to be in place. The stand is one of the best ways to invest and if a trader is able to get in on a great contract they will see a healthy profit.

Commodities Trading Benefits:

- Excellent market liquidity on all major contracts, as well as tight spreads

- Trade agricultural products, oil and energies, base metals, precious metals, bonds, currencies, short-term interest rates, meats, softs and stock indices

- Trade well over 450 instruments on live market prices from over 15 exchanges around the world

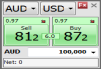

Trade Currencies, Oil, Gold and Energies

Online Futures trading with Spectrum Live opens up the world's major markets, from Chicago to Singapore, at low commission rates. You can access a huge range of products – from oil and metals to currencies, bonds, agriculturals and indices – across the global Futures markets, including CMEGroup, Eurex and Euronext.