Trading CFDs and Trading Stocks | CFD Trading Platform | Stock Trading Platform | Stock Trading Broker | Spectrum Live

Trading CFDs and Trading Stocks

Trading CFDs here at Spectrum Live is made easy. Your Contract For Difference trading platform allows you access to over 20 exchanges where Contratcs For Difference are traded offering you competitive spreads.

The use of Share Contracts For Difference date back to the 1980's when they were used by institutions to cost efficiently hedge their equity exposures. It wasn't until the late 1990's that they became available to private clients. The Financial Services Reform Act (FSRA) came into effect in Australia on 11 March 2002. It opened the market for international firms to offer products previously unseen in Australia.

These days, a growing number of retail investors use CFDs both as part of their trading portfolio and as an alternative to physical share trading. This group includes both short term frequent traders as well as long term investors looking for a flexible alternative to margin lending.

A Contract for Difference, or 'CFD', is a contract between you and Spectrum Live to settle the difference in cash between the price at which you buy the Contract For Difference and the price at which you sell.

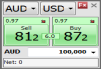

The price of a share Contract For Difference mirrors the underlying share price. For example, if the price of IBM is quoted on the exchange at $85.16 (Bid) - $85.17(Ask) then the Contract For Difference on IBM will have the same quote. If the price of IBM moves up in the underlying market then so does the Contract For Difference. For most markets there is no difference between the Contract For Difference prices and the underlying share prices in the physical market.

Therefore, instead of buying or selling physical shares, the Contract For Difference holder gets access to the performance – or price movements of a share – without ever having to take delivery of the actual shares. That is, CFDs allow you to receive most of the benefits of owning a security (share) without having to actually own the security (share). In other words you do not take delivery of the security so any difference in the price between when you buy the Contract For Difference and when you sell it is settled in cash. The difference is either profit or loss.

Contracts For Difference are also available on indices and baskets of securities. CFDs in relation to baskets of securities are known as Sector CFDs. An example of index CFDs is the S&PASX 200. An example of a Sector Contract For Difference is the Oil Sector Contract For Difference . Buying and selling the performance of a security or index using a Contract For Difference is similar to buying the actual underlying instrument using a loan.

Share | Stock Trading

A stock is generally defined as part ownership in a company or owning some of the company’s assets or earnings. Stock trading has been one of the most famous ways to make money trading. Generally stocks are sold by the original owners of a company in order to get extra revenue so that the company can grow much faster with loans from investors. Long after this stage of the initial sale of stocks shares can be traded and resold using the stock market. Many stocks also come with dividends for shareholders which means by investing in a certain stock a trader is able to make small amounts of money at the end of the year or at the end of the quarter just for holding the stock.

Generally accompanied is doing well or selling lots of product than their stocks will rise in price. Because of fluctuations within the price of stocks an investor is able to buy low when a company is not doing so well or when a company is just starting out and sell the stocks when they have reached a high market value. By investing in multiple forms of stock from many different companies and actively tracking the market traders are able to make many different profits over the course of a market day.

The main aspect of stock trading is that the person must be very informed as to what each company is doing and also closely watch the markets to make sure the numbers are reflecting advancements in sales in the companies. Predicting the market can be very difficult but can pay off huge when it comes to investing in stocks.

Investing in stocks can be done in a number of different ways the first of which is with a broker. The broker can help a trader to make informed decisions and actually go about trading the stock for them. Generally a broker will charge their own fee which takes away from the profits that a person may make on the stock trade. A broker is able to carefully watch the markets and trends in order to alert a trader or investor that their stock is ready to sell or is not doing particularly well. Brokers can buy and sell stocks both electronically and over an exchange floor trading system.

Many investors have taken to trading their stocks electronically over the Internet using a number of different services which are available online. It’s important to look at the commission that is charged on each trade on these websites as this could result in lost profit from each of your trades. Stocks can be traded freely using these electronic services and allow people to trade stocks rate from home to make a profit. This can be quite profitable but it requires a proper amount of research and experience in order for a trader to be successful, many have lost a fair amount of money in online trading without proper experience.

Stock trading will continue to be one of the most profitable ways to make money with online trading and traditional trading methods. With many new companies starting every day there are always new stock options and markets are consistently changing to reflect different stock options and profit margins for potential investors.