Trading ETFs | Commodity CFDs | Exchange Traded Funds | Spectrum Live

ETF's or Exchange Traded Funds

An exchange traded fund is very much like a stock in the way that it is traded. Exchange traded funds track indexes such as the NASDAQ 100 were Dow Jones and when you buy into shares of an exchange traded fund you are essentially buying shares in a portfolio that tracks the return on that native index. ETF’s are good as they run at a very low cost to the investor and don’t rely on a huge competition-based system but only rely on whether or not the market has gone up or down as a whole within the index.

Shares within an exchange traded fund are divided up by the index itself. Generally the size of an exchange traded fund raises from 25,000 shares to up to 200,000 shares which are also nicknamed creation units.

ETFs are usually available at much lower costs to the investor because they do not so much required the competition that a stock or other investments do. UGS can be bought at any time during the trading day and also do not have the same sort of supply and demand mentality that stocks and commodities have. The person will be able to buy or sell an ETF at any time throughout the trading day and never have to worry about weeding for demand in order to get rid of their investment if it is doing poorly.

Many have taken to using ETF’s rather than investing in mutual funds. Because in ETF invests a person’s money and requires only fairly low commissions from a broker to invest the money is a very attractive and easy way to invest money to see growth over the long term. Taxes on ETFs are structured in a much different way than they are on an investment like a mutual fund. Any gain on a mutual fund is taxable to all of the shareholders were ETF’s are not redeemable until the share is sold. This can save an investor countless dollars from paying capital gains tax on their mutual funds, by investing in ETFs instead of mutual funds.

There is flexibility with trading exchange traded funds. Because they require no minimum investment investors can vary slowly invest money and trade ETF’s as long as the market is open. ETF’s can have options rigged against them and also have a number of different market strategies which are used, for stock trading such as selling short, limit orders, stop-loss orders and buying on margin.

As with any investment there are a number of risks associated with ETFs. However this risk is quite limited in the fact that as long as markets remain strong as a whole ETF’s will keep their value. Over a long term investment and ETF is an attractive investment. However in times when the market is quite volatile it can lead to heavy losses in terms of ETF investments.

Best way to get involved with ETF investments is through a broker.

Exchange traded funds are fairly new way to invest but are gaining heavy popularity. They remain one of the most secure investments that somebody can make in the stock market.

Benefits of trading Exchange Traded Funds with Spectrum Live:

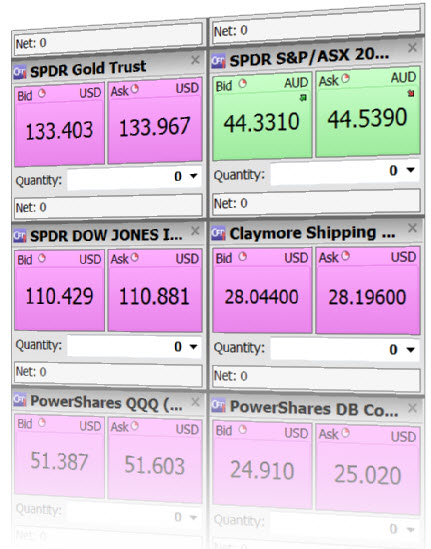

- Access to 650 ETFs from a selected range of Tier one providers

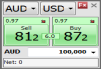

- Straightforward trading on live prices

- Extensive ETF charting and analysis tools

- Ability to using ETF investments as collateral for margin product trading

- Availability of Inverse ETFs that allow investors to potentially benefit on falling prices and Leveraged ETFs that offer a fixed amount of leverage on certain securities.

Commodity CFDs

Commodity CFDs are the new and easy way to trade commodities markets. Now investing in oil, grains, softs, energies, gold and other precious metals is as simple as trading any other CFD products. CFD Commodities give traders and investors direct exposure to the underlying commodity with the trading features of a CFD.

Instead of trading on the Futures exchanges – with sometimes prohibitive lot sizes and high collateral requirements – investors can now access leveraged commodity trading with reduced collateral through Commodity CFDs. For instance, the lot size of a US Crude Oil CFD is 25 barrels, compared to the Futures contract size of 1,000 barrels, which means easier and more flexible trading.

Benefits of trading Commodity CFDs:

- 5% Margin on the first EUR 50,000 (20:1 Leverage).

- Standard margin is 10% Smaller lot sizes compared to futures for increased flexibility

- Easy-to-understand single-unit pricing

- One-click trading of oil, gold, grain and other major commodities

- Simple cash settlement in line with the underlying Future

- No commissions on Commodity CFDs aside from Bid/Ask spreads

- Short selling is fully supported.