Stocks in the US fall for a third day $XAGUSD

- Published: 07 January 2014

- U.S. stocks fell for a third day, the longest stretch of declines for the Standard & Poor’s 500 Index to start a year since 2005, after slower-than-forecast growth in service industries.

- The U.S. equity benchmark retreated 0.5 percent last week as investors sold shares after the biggest annual gain in more than a decade. The S&P 500 jumped 30 percent in 2013, its best performance since 1997.

- The S&P 500, which finished last year at an all-time high, sank the most in three weeks on Jan. 2, snapping a streak of rallies on the first session of the year since 2009. The Dow average climbed 27 percent in 2013 for its best performance since 1995.

- Dow Jones -0.27% S&P 500 -0.25% and NASDAQ -0.44%

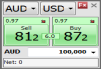

- The Australian dollar has bounced back after suffering a brief fall on the back of some disappointing Chinese economic data. AUDUSD is currently trading at 0.8966.

- Oil prices extended last week's sharp losses Monday on flat demand for crude and amid higher Libyan production, analysts said New York's main contract, West Texas Intermediate (WTI) for delivery in February, dropped 42 cents to $US93.54 a barrel after rising earlier in the day.

- Gold had risen to a three-week high, leading some technical analysts to say that another strong close for the shiny metal could lead toward $US1,260 per ounce. However by mid-morning gold had scaled back, and was just 0.2 per cent higher from Friday's price at $US1,237.80