S&P500 has bes annual gain since 1997 $DDD

- Published: 06 January 2014

- Investors in U.S. stocks will look to Washington this week, awaiting key jobs data and minutes from the Federal Reserve's most recent meeting, when the central bank decided to cut its unprecedented monetary stimulus.

- Apple slumped 3.4% after Wells Fargo & Co. cut its recommendation on the stock to market perform from outperform, saying the iPhone maker’s gross margin could come under pressure later in the year. Bank of America Corp. climbed 4.7% as Citigroup Inc. advised investors to buy the company’s shares.

- The S&P 500, which finished last year at an all-time high, sank the most in three weeks on Jan. 2, snapping a streak of rallies on the first session of the year since 2009. The Dow average climbed 27 percent in 2013 for its best performance since 1995.

- Delta Air Lines Inc. increased 8.1 percent to $29.23 for the biggest gain in the S&P 500. The airline carrier reported that key revenue rose 10 percent in December from a year earlier. The company said it expects to report more than $1 billion in operating cash flow for the quarter.

- Dow Jones +0.17% S&P 500 -0.03% and NASDAQ -0.27%

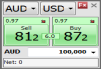

- The yen and Australian dollar, the two worst-performing major currencies last year, posted the first weekly increases in more than two months on speculation their recent declines were too rapid. Australia’s dollar climbed 0.4 percent to 89.45 U.S. cents after adding as much as 1.1 percent.

- West Texas Intermediate crude fell, capping the biggest weekly decline in 19 months, after a government report showed that U.S. supplies of distillate fuel and gasoline climbed.